The U.S. Securities and Exchange Commission, China's Great Economic Weapon

To protect U.S. elite investments in China, the SEC is purposefully concealing China-based executives financial crimes in the U.S. capital markets.

Attorney General Garland was correct: America's greatest threat comes from within, and it is also white, but it is not white supremacy. It is Washington's egregious failure to defend American industries (businesses) from an affluent, primarily white, U.S. elite and Chinese Communist Party (CCP) construct being used to decimate America’s position as the world's preeminent economic power.

Americans were misled a decade ago into believing that improving China-U.S. relations through mutual investment in each other's future would enable us to work together on issues like human rights and climate change. The political class — Washington, Wall Street, Tech Elite— reaped massive profits from their personal China investments, while the American people were duped.

Alexander Hamilton forewarned us of this enormous danger in 1787:

A trust-based economic system which encourages innovation is critical to America's success. Even if you don't own stocks, the integrity of our capital markets affects everyone in the country.

The independent regulatory body charged with preserving public confidence in our financial system is the Securities and Exchange Commission (SEC). The President appoints the SEC's Chairman and fills vacancies on the five-member commission. However, the SEC is directly overseen by Congress (the People) in order to avoid executive branch influence.

In 2013, under the Obama administration (Biden and Kerry), the SEC entered into an agreement that enabled China and harmed America

The U.S. Constitution prohibits any executive branch agency, independent or not, from deciding who is governed by our laws, let alone granting exceptions to communist Chinese corporations with a track record of defrauding investors.

But that is exactly what happened during the Obama-Biden administration. On May 7, 2013, the Public Company Accounting Oversight Board (PCAOB), which is under the SEC's supervision, signed a Memorandum of Understanding (MOU) with China’s SEC-like regulatory body. Outrageously, China-based auditors were permitted in article III of the MOU to violate U.S. law. Why would anybody sign an agreement that denied regulators (PCAOB) access to information used to verify financial numbers?

The SEC granted China an exception to following US capital market laws in 2013 without authority. This violated the Sarbanes-Oxley Act —a piece of legislation passed by Congress in 2002 to restore confidence in our markets and prevent the next Enron. The China free pass ignored the original reason for the talks: Chinese companies were defrauding investors. It also gave Chinese companies an unfair competitive advantage by allowing them to benefit from the capital, liquidity, and reputation boost associated with a U.S. listing while avoiding compliance with the laws.

Even worse, the SEC used the 2013 non-binding MOU as an excuse to not investigate Chinese executives frauds for the next ten years. The American people have been deceived out of trillions of dollars.

The 2013 China MOU, predictably occurred, while then-Vice President Joe Biden and then-Secretary of State John Kerry were negotiating more comprehensive agreements with China through the U.S.–China Strategic and Economic Dialogue (S&ED) including a bilateral investment treaty. Standing alongside then-VP Biden on Valentine's Day in 2012, VP Xi Jinping stated:

"We should tap our cooperation potential, create more bright spots in our cooperation, and strive for greater balance in trade and investment between the two countries."

Xi had recently been promoted to the CCP's top position in March 2013. Biden and Kerry gave Xi Jinping and the CCP a gift by granting Chinese companies unrestricted access to American capital without any regulation. This decision harmed America while fostering the CCP's rapid economic expansion.

Biden and Kerry, wealthy donors, and the CCP all gain, but not America

China's economic rise has been described as miraculous by the Wall Street elite, many of whom are political donors. This description totally ignores the fact that the U.S. government created a loophole that allowed a Communist country, China, to harm American businesses and industries.

The possibility that China corrupted the Biden family has received extensive media coverage. Many of the financial transactions (investments) in question occured immediately following the CCP negotiations to access to U.S. capital markets without following our laws that Biden spearheaded.

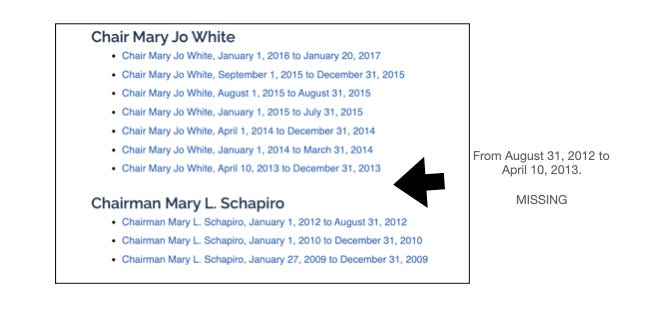

The SEC Chairman’s calendar for that period is missing on the SEC website where the Chairperson’s calendar is published.

A search of Hunter's emails turns up no emails from May 8, 2013 to December 31, 2014. This was a critical period in the Obama-Biden administration China negotiations.

What is captured on the laptop is that Goldman Sachs started investing tens of millions of dollars in Hunter Biden and Devon Archer’s technology fund, Rosemont Seneca Technology Partners (RSTP) shortly after the China MOU was signed. Goldman stood to profit greatly from China IPOs. They were now paying investment management fees to Hunter Biden (and his team) and Devon Archer (along with John Kerry’s stepson Chris Heinz), according to an April 2014, email.

The RSTP investments were made by Goldman Sachs (Alternative Investment Management group). The transactions can be verified through both emails, in addition to SEC filings RSTP II Alpha, LLC and RSTP II Bravo, LLC.

Besides the Goldman funds, Hunter Biden, was also set-up with a lucrative investment fund via a joint-venture in China. While spending the weekend in Arizona with his father and brother on February 28, 2014, Hunter forwarded an email that contained a copy of the first article (in China) about the new CCP approved cross-border fund (BHR partners) in the recently established Shanghai free trade zone :

“We are the first one finalized among over 30 M&A fund under application process in Shanghai FTZ ”, introduced Mr. Johnathan Li. Bohai Huamei is started and formed by four Chinese or international professional investment institutions, which includes Bohai industrial investment fund management Co. (Bohai), Shanghai ample harvest financial services Co.(Harvest), Rosemont Seneca Partners, LLC Rosemont) and Thornton Group LLC.

Hunter Biden was already benefiting financially from his father’s new investment pact with Xi Jinping. One of the main source of funds for the new China-based investment entity was the state-controlled Bank of China, who was the owner of Bohai capital. Other Chinese government-associated groups also invested in the rumored $2 billion fund, according to emails on the laptop.

Update: RSTP's Goldman contact inquired in a May 2014 email titled “Article on Devon/Hunter” about how she should position Hunter and Devon Archer's Ukraine energy board appointments when providing valuable references to other prospective LP's in their fund (investors). Goldman wasn’t just investing - they were helping them raise the entire fund by providing references. The email thread shows that there was clearly concern at Goldman Sachs' that their support for Biden and Archer would draw attention. After all, Hunter's father was influencing policy, including that of China, which had a direct impact on Goldman's business.

The current Climate Czar John Kerry even got in on the China investment game after he left office as Secretary of State. Kerry’s recent financial disclosures list an over $1 million investment in Yale-connected Hillhouse China Value Fund LP by his wife. This investment likely occurred in 2017 and is still maintained. Over a ten-year period, the expected return on a private equity investment like this for Kerry is between $15 million and $20 million.

Senator Grassley, a Congressional warrior, is looking into potential Biden corruption. FBI whistleblowers have recently come forward with information regarding substantial impartiality in the FBI's ongoing investigation of the President's son and his foreign dealings, including China.

In 2014, Chinese companies Autohome (Goldman, Deutsche Bank), Weibo (Goldman, Credit Suisse), and JD.Com (Merrill Lynch, UBS), among others, sold a portion of their companies to US investors via public listings.The American elite were also investing heavily in China through private equity and venture capital funds.

Then came the biggest IPO in history, Alibaba

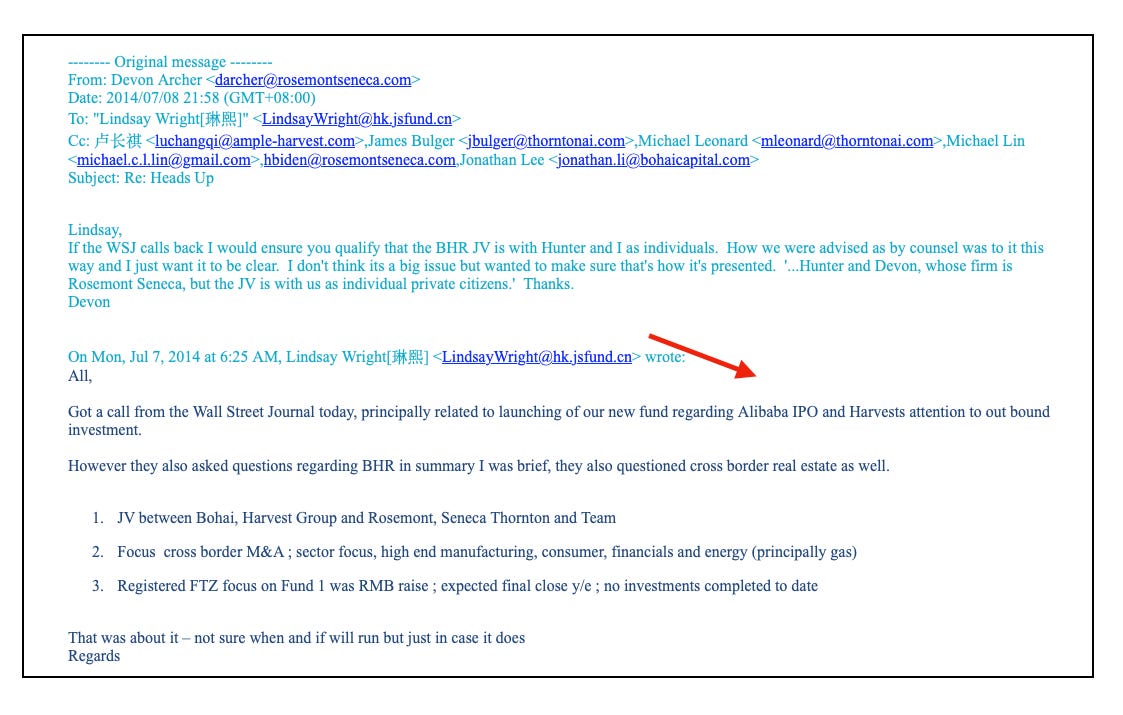

On July 7, 2014, an email exchange from Biden's laptop titled Heads Up referenced an inquiry from the Wall Street Journal, about Biden’s new investment fund making an investment in Alibaba pre-IPO. It is unknown whether the Biden fund invested in Alibaba, but the entire email exchange appeared to be fraught with anxiety.

Biden and Archer’s new China investment funds was so unusual from how the CCP typically restricted foreign investment that the Wall Street Journal did run the story on July 10, 2014. But somehow no one in Washington knew what was transpiring.

While our own government set up a deal that allowed Chinese companies to violate international norms and U.S. laws, wealthy American investors funded China's rise. The loss of jobs in America was acceptable because the rich got richer.

Goldman Sachs, Gary Cohn puts Alibaba IPO team in at the SEC

On September 19, 2014, attorneys William "Bill" Hinman (Simpson Thacher) and Walter Joseph "Jay" Clayton III (Sullivan & Cromwell) completed the largest IPO in history, Alibaba (BABA).

Clayton represented the underwriters (Goldman Sachs and Credit Suisse), while Hinman represented Alibaba. Their law firms received substantial ongoing fees from not only Alibaba, but also from other Chinese companies over the next few years. Wall Street’s future gravy train after they blew up the housing market was China.

In December 2016, Gary Cohn, the President of Goldman Sachs and a long-time Democrat globalist, was appointed as the new Director of the White House Economic Council by President Trump. According to the Wall Street Journal, Cohen was concentrating on assembling Trump's economic team for financial regulation, which would include the SEC.

On January 4, 2017, Jay Clayton, a career Wall Street attorney at Sullivan & Cromwell and Goldman Sachs' go-to lawyer, was named Chairman of the SEC. Clayton’s wife also worked for Goldman; the wealthy couple were long time Goldman customers. They were also Goldman shareholders. [Note: Jay Clayton attempted to conceal from the public who recommended him for the SEC Chairman job, only revealing that it was a former client.]

In late January and early February 2017,Michael Piwowar, the interim Chairman of the SEC, greatly reduced the number of SEC employees with subpoena authority while Clayton was awaiting Senate approval. In a highly unusual lame duck move, Piwowar shrunk opening investigations down from about twenty people to just two, directly under the Chairman.

On May 4, 2017, Clayton was sworn into office. William Hinman from Simpson Thacher, with whom Clayton had previously worked with on Alibaba's IPO, became Clayton's first senior hire. Clayton's former Sullivan & Cromwell colleague Steve Peikin was also announced as Co-Director of the SEC's Enforcement Division at the end of May 2017. The Wall Street team was assembled at the SEC. Goldman Gary Cohn had done his work.

While Clayton, Peikin, and Hinman were at the SEC, it was well known that they had no intention of reversing the Biden China MOU gift from 2013, which was benefiting their friends while damaging American interests.

In fact, the committee on Present Danger China wrote congress about Clayton’s China nonfeasance, and former SEC Commissioner Arthur Levitt Jr. penned a Wall Street Journal titled The SEC’s China Evasion.

Blockchain infrastructure opportunity for Wall Street

In 2017 and 2018, the blockchain and cryptocurrency markets were heating up. This was the hot new market. Wall Street could make a lot of money by putting together funding for innovative new businesses that would run the blockchain infrastructure. Companies like Bitmain, Cannan, and Ebang. The first wave of Internet companies was dominated by ISPs, Cisco Systems, Nortel, and fiber companies and Wall Street saw considerable parallels with blockchain.

Wall Street was salivating over blockchain infrastructure, but there were two major barriers to sell shares in companies to the public.

First, there was a lack of clarity in regulations regarding which cryptocurrencies were securities and the SEC's process for determining this. This risk needed to be removed for Bitcoin and Ether mining companies to go public.

Second, because a large portion of the companies building the infrastructure were proof-of-work based networks like Bitcoin and Ether were located in China, the IPO market needed to remain open for Chinese companies. Chinese companies are always one fraud away from being confronted. The cost of operating the mining equipment, supporting costs, and pooling software was a lot lower in China. It also appeared the Chinese Communist Party (CCP) was interested in playing a leading role in digital currencies and blockchain infrastructure.

Gary Cohn resigns over China tariffs

On March 6, 2018, Clayton confidant and Globalist Goldman Gary Cohn left the White House in protest of President Trump's steel and aluminum tariffs on China.

Fear not; the SEC has its China team

The Alibaba IPO team, including Cohn’s plant and the go-to Goldman attorney, Jay Clayton was running the SEC with his cadre of Wall Street connected attorneys.

On June 14, 2018, just a few months after Cohn’s resignation, William Hinman gave his now infamous and legendary personal opinion at the Yahoo Finance All Markets Crypto Summit, which appears to be edited by every senior staffer at the SEC. Hinman stated:

“And putting aside the fundraising that accompanied the creation of Ether, based on my understanding of the present state of Ether, the Ethereum network and its decentralized structure, current offers and sales of Ether are not securities transactions.”

Ether took off before Hinman could drop the microphone, but more significantly for Clayton and Hinman's friends on Wall Street, the path was cleared for the pipeline of Bitcoin and Ethereum blockchain infrastructure companies to go public. Clayton and Hinman’s law firms were about to cash in on the shocking declaration, as would the Wall Street investment banks. They could pay them back later - which they have done with new advisor roles.

Hinman's speech fueled a wave of potential blockchain infrastructure IPOs while also keeping the overall China door open for Wall Street. China was being scrutinized by the Trump administration, and there was talk of a trade war. A robust China IPO pipeline was one way for the China lobby in the administration to keep President Trump, who liked to point to his presidency's public market successes, from confronting China directly.

Hinman and Clayton's SEC Ether declaration was intended to open the door for their Wall Street friends' IPOs, but it also kept the China IPO door open in the U.S. for a substantial pipeline of elite investments in China.

Hinman's interactions with former colleagues China, and the SEC's decisions create probable cause to investigate

Bill Hinman was instructed multiple times by Shira Minton, Ethics Counsel in the Office of Ethics Counsel at the SEC with Danae Serrano, SEC Ethics Counsel Cc’d that he had a “bar under the criminal financial conflict” with his prior law firm, Simpson Thacher. Hinman was not allowed to even call his former coworkers at Simpson Thacher because he continued to have a financial stake in the firm's partnership.

Any contact could trigger a violation of criminal code 18 U.S. Code § 208, Acts affecting a personal financial interest. Despite being a sophisticated attorney, Hinman choose to meet with his prior law firm, Simpson Thacher, at least three times, according to emails obtained from the SEC through a Freedom of Information Act (FOIA) request by Empower Oversight.

One of those criminal meetings was in August 2019 with a Simpson Thacher partner from the Hong Kong, China office. Hinman’s former colleague wanted to get together so he could “report what is going on in China.”

To make matters worse, on July 23, 2019, Chris Lin (Simpson Thacher) filed a draft IPO registration statement with the SEC for Cannan, a China-based computer and hardware company that manufactures hardware for crypto mining.

Not only was Mr. Hinman deliberately ignoring SEC ethics and likely breaking the law by meeting with Mr. Lin, but Mr. Lin also had direct business in front of Hinman's Corporate Finance Division at the SEC. After numerous correspondences with the SEC, the Chinese mining rig company Canaan launched its IPO on November 21, 2019.

Furthermore, Mr. Lin had Simpson Thacher clients in China who were the subjects of serious allegations of securities fraud filed with the SEC's enforcement division. The subjects of the claims also transacted a sizable amount of business with Sullivan & Cromwell, the law office of Chairman Clayton, and Co-Director of Enforcement Steve Peikin. Mr. Clayton repeatedly met with Sullivan & Cromwell leadership.

The day after Clayton resigned on November 17, 2020, in his final Senate Banking Testimony Clayton stated:

While the federal securities laws and regulations applicable to emerging market companies listed on U.S. exchanges are the same as (or comparable to) the laws and regulations applicable to U.S. public companies, the practical effects are substantially different, due to the inability of U.S. regulators to inspect for compliance and enforce these rules and regulations. This is a fundamental issue in emerging market investing that I believe investors, particularly our Main Street investors, should better understand. This status quo of a materially unlevel playing field with respect to PCAOB inspections for issuers from certain emerging markets is unacceptable.

Clayton's right hand man was meeting with his former law firm's China team. Despite being an attorney on the largest Chinese IPO, Clayton did nothing to combat Chinese fraud during his entire tenure at the SEC. On his way out the door, he expresses his dissatisfaction with Joe Biden's gift to Xi Jinping.

A month later, on his last day as a Commissioner, Clayton would join two Democratic commissioners in filing a historic action in the cryptocurrency space against XRP/Ripple, erasing $15 billion in value overnight. According to the SEC's hypocritical arguments revealed in court documents, there is a strong belief that Clayton filed the complaint to appease the incoming administration. No doubt, he had something to hide, and likely it is related to China.

Gary Gensler, a former employee of Goldman Sachs and Hillary Clinton's CFO, becomes Chairman of the SEC.

Gary Gensler was nominated by President Biden. The same Biden who is being investigated by Senator Grassley for corruption related to his sons foreign dealings. Rumors have widely circulated that Gensler had been told to go soft on China and Wall Street by the administration.

The Department of Justice (DOJ) China Initiative was ended in February 2022 by the administration because it was believed to be racist.

Despite the fact that civil lawsuits have already been filed regarding the $65 billion wipe out of investor funds at DiDi, Gensler has not yet brought any legal action against the Chinese listed company. E-mails on Hunter Biden’s laptop reference an investment interest in DiDi. All the SEC would need to do is read the well-crafted civil complaint and issue some subpoenas.

Falsely, Gensler has attempted to paint the China PCAOB audit issue as the only problem with Chinese companies. Not every problem with Chinese companies is related to audit transparency. Massive problems still exist because there is no independent governance at these companies and their executives are fully aware they will not be held accountable for crimes.

Last summer, Representative Bradley Sherman, from Gensler’s own party sent a letter asking why the SEC is not pursuing securities fraud vs. a particular Chinese company that entered into a civil settlement. No public response was provided.

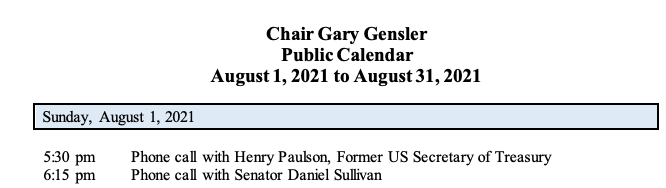

Chairman Gensler received a letter from seven senators about the SEC’s China nonfeasance in July 2021. Prior to the call with Senator Sullivan (R-AK), Gensler is documented speaking with former Goldman Sachs CEO and well-known Chinese cheerleader Hank Paulson. A strange call for a Democratic appointed SEC Chairman. Paulson is well-known for pressuring D.C. policymakers for favorable China outcomes.

Gensler appears uninterested in restoring the SEC's reputation. It is unknown if he has made a criminal referral in relation to the recently discovered Hinman/Clayton information.

Gensler has substantial personal holdings (millions) in two Vanguard funds heavily weighted in Chinese stocks.

Gensler is doing repeated meetings with Climate Czar John Kerry while negotiating with Chinese regulatory bodies despite climate having nothing to do with Chinese companies access to U.S. markets. It would be difficult to believe that Kerry isn’t again, like in 2013, stressing the importance of giving into the CCP in the name of protecting the climate.

The SEC enforcement data supports that Gensler has done nothing to confront Chinese security fraud as he comes up on two years in office.

Conclusion

Because our government officials permitted China to corrupt the SEC, American business, the economy, and ultimately our national security have all suffered significantly.

It's time for the SEC's support of China at the expense of America to be looked into by Congress, the Department of Justice, and/or a Special Counsel (involves the President).

In addition, we should pursue financial restitution for the harm done to the American people's finances. There is no excuse for the U.S. government to not at least warn the international community of what to expect as China grows its own capital markets in Beijing, Shanghai, Shenzhen, and Hong Kong that function in a setting devoid of the rule of law and free speech.